Search Results for author: Ali Hirsa

Found 12 papers, 0 papers with code

Saddle-Point Approach to Large-Time Volatility Smile

no code implementations • 12 Dec 2022 • Chun Yat Yeung, Ali Hirsa

We extend upon the saddle-point equation presented in [1] to derive large-time model-implied volatility smiles, providing its theoretical foundation and studying its applications in classical models.

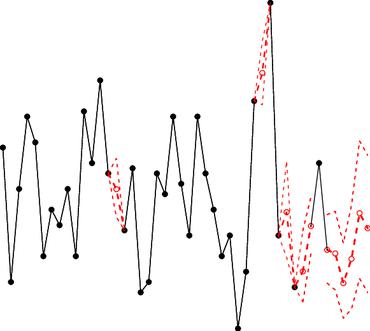

Post trade allocation: how much are bunched orders costing your performance?

no code implementations • 13 Oct 2022 • Ali Hirsa, Massoud Heidari

However, as many have found over the years, there is no simple solution for post trade allocation between accounts that results in a uniform distribution of returns.

Simulating financial time series using attention

no code implementations • 1 Jul 2022 • Weilong Fu, Ali Hirsa, Jörg Osterrieder

It is also challenging because of the complex statistical properties of the real financial data.

Solving barrier options under stochastic volatility using deep learning

no code implementations • 1 Jul 2022 • Weilong Fu, Ali Hirsa

We develop an unsupervised deep learning method to solve the barrier options under the Bergomi model.

Predicting Status of Pre and Post M&A Deals Using Machine Learning and Deep Learning Techniques

no code implementations • 5 Aug 2021 • Tugce Karatas, Ali Hirsa

We also integrate sentiment scores into our methodology using different model architectures, but our preliminary results show that the performance is not changing much compared to the simple FFNN framework.

Supervised Neural Networks for Illiquid Alternative Asset Cash Flow Forecasting

no code implementations • 5 Aug 2021 • Tugce Karatas, Federico Klinkert, Ali Hirsa

In this paper, we develop a benchmark model and present two novel approaches (direct vs. indirect) to predict the cash flows of private equity funds.

Two-Stage Sector Rotation Methodology Using Machine Learning and Deep Learning Techniques

no code implementations • 5 Aug 2021 • Tugce Karatas, Ali Hirsa

In this paper, we propose a two-stage methodology that consists of predicting ETF prices for each sector using market indicators and ranking sectors based on their predicted rate of returns.

Deep reinforcement learning on a multi-asset environment for trading

no code implementations • 15 Jun 2021 • Ali Hirsa, Joerg Osterrieder, Branka Hadji-Misheva, Jan-Alexander Posth

Our trading strategy is trained and tested both on real and simulated price series and we compare the results with an index benchmark.

Explainable AI in Credit Risk Management

no code implementations • 1 Mar 2021 • Branka Hadji Misheva, Joerg Osterrieder, Ali Hirsa, Onkar Kulkarni, Stephen Fung Lin

Artificial Intelligence (AI) has created the single biggest technology revolution the world has ever seen.

BIG-bench Machine Learning

BIG-bench Machine Learning

Explainable Artificial Intelligence (XAI)

+1

Explainable Artificial Intelligence (XAI)

+1

Regularized Generative Adversarial Network

no code implementations • 9 Feb 2021 • Gabriele Di Cerbo, Ali Hirsa, Ahmad Shayaan

We propose a framework for generating samples from a probability distribution that differs from the probability distribution of the training set.

The VIX index under scrutiny of machine learning techniques and neural networks

no code implementations • 3 Feb 2021 • Ali Hirsa, Joerg Osterrieder, Branka Hadji Misheva, Wenxin Cao, Yiwen Fu, Hanze Sun, Kin Wai Wong

Using subset selection approaches on top of the original CBOE methodology, as well as building machine learning and neural network models including Random Forests, Support Vector Machines, feed-forward neural networks, and long short-term memory (LSTM) models, we will show that a small number of options is sufficient to replicate the VIX index.

Supervised Deep Neural Networks (DNNs) for Pricing/Calibration of Vanilla/Exotic Options Under Various Different Processes

no code implementations • 15 Feb 2019 • Ali Hirsa, Tugce Karatas, Amir Oskoui

We apply supervised deep neural networks (DNNs) for pricing and calibration of both vanilla and exotic options under both diffusion and pure jump processes with and without stochastic volatility.