No-Transaction Band Network: A Neural Network Architecture for Efficient Deep Hedging

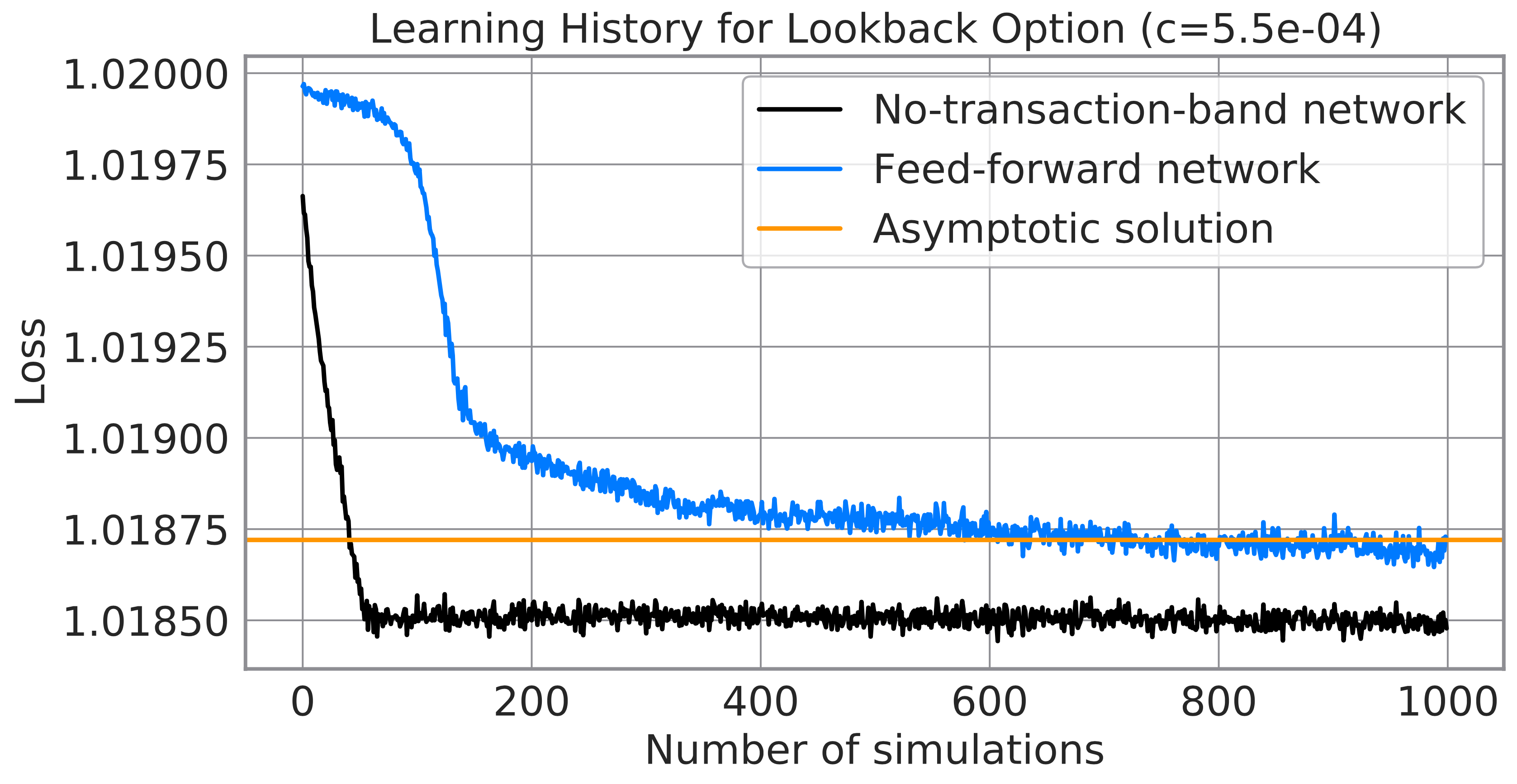

Deep hedging (Buehler et al. 2019) is a versatile framework to compute the optimal hedging strategy of derivatives in incomplete markets. However, this optimal strategy is hard to train due to action dependence, that is, the appropriate hedging action at the next step depends on the current action. To overcome this issue, we leverage the idea of a no-transaction band strategy, which is an existing technique that gives optimal hedging strategies for European options and the exponential utility. We theoretically prove that this strategy is also optimal for a wider class of utilities and derivatives including exotics. Based on this result, we propose a no-transaction band network, a neural network architecture that facilitates fast training and precise evaluation of the optimal hedging strategy. We experimentally demonstrate that for European and lookback options, our architecture quickly attains a better hedging strategy in comparison to a standard feed-forward network.

PDF Abstract